Mykonos, Paros and Santorini remain among the leading destinations in the Mediterranean, further establishing their investment dynamics in the post-pandemic holiday home market, according to Algean Property, who completed an annual review of 30 locations across the Mediterranean region.

In the report, Algean said that in the last few years, the holiday home market in the Mediterranean has steadily evolved from a promising real estate segment into the most dynamic and active sector of the real estate industry in this area.

“Demand across Mediterranean holiday destinations skyrocketed during the pandemic, with Greece, Spain and France leading the race. Yet, there are exceptions to this narrative with some locations experiencing small increases in yields and others experiencing a more substantial increase, mostly explained by rent figures growing faster than the sale price,” it said.

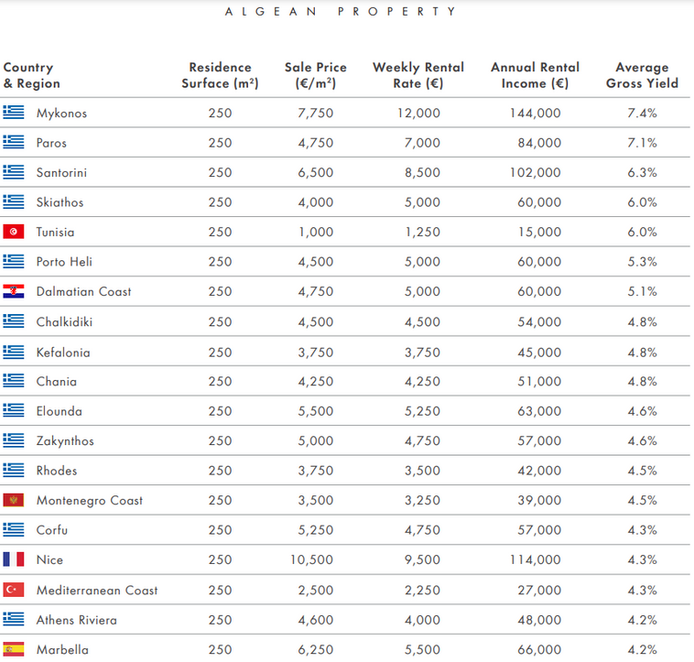

For another year, Mykonos tops the list of best performers with an average gross yield of 7.4%. Paros (7.1%) is one of the destinations that were able to increase its yield compared to 2019 (6.5%). Although prices increased, rent growth outpaced sales prices growth resulting in a higher yield, further closing the gap with Mykonos. Overall, Paros has been able to benefit from Mykonos’s spillover effects with the islands being geographically near to each other.

“This has allowed for new investments and more luxurious projects being built, increasing sales price while the greater number of tourists and pent-up demand from the pandemic has allowed rents to rapidly grow,” the report said.

Santorini’s sale price and rents experienced a slight increase compared to 2019 but overall performance remained the same with 2019 (6.3%). Skiathos and Tunisia share the 4th and 5th spot with sale prices, rents and yields remaining unchanged compared to 2019 (6.0%).

The sixth spot is reserved by Porto Heli (5.3%) which was able to increase yields compared to 2019 (5.1%) as a result of a slight decrease in sale prices, whereas the Dalmatian Coast remained in the 7th spot with sales prices, rents and yields remaining unchanged compared to 2019 (5.1%).

The top 10 destinations are completed by Chalkidiki, Chania and Kefalonia which all share the same yield of 4.8% with Kefalonia experiencing a significant increase in its yield compared to 2019 (4.1%) explained by rent growth outpacing sales price growth.

The remaining 20 destinations recorded the following average gross yields: Elounda (4.6%), Zakynthos (4.6%), Rhodes (4.5%), Montenegro Coast (4.5%), Corfu(4.3%), Nice (4.3%), Turkey – Mediterranean Coast (4.3%), Athens Riviera (4.2%), Marbella (4.2%), Turkey – Aegean Coast (4.0%), Mallorca (3.7%), Saint-Tropez (3.7%), Messinia (3.6%), Sardinia (3.5%), Tel Aviv (3.4%), Ibiza (3.3%), Cannes (3.3%), Capri – Amalfi Coast(3.3%).

This article was first published here.

For more Real Estate News & Views on Greece and Europe’s South, head to The Greek Guru.

*Image courtesy of Sotheby’s Greece